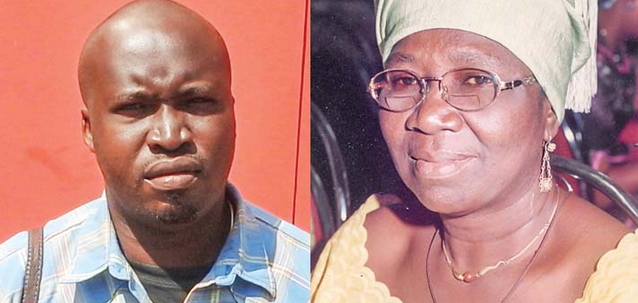

Dead Woman Withdraws Money From First Bank, Son Petitions Police

For those who knew Mrs Cordelia Iwegbuna Idowu Okocha, it is no news that she died of breast cancer, at the age of 50 on August 7, 2004, and was buried in September 2004. What is certainly news and shocking too, is that four years after her death, she ‘visited’ her bank and withdrew more than N527,500 from her savings account in a first generation bank (name withheld).

The statement of account of the dead woman indicated that she withdrew N500,000 by ‘self ’ on February 19, 2008. On February 28, 2008, she made another withdrawal of N27,500 by ‘self’. She made all the withdrawals at the Awolowo Road branch of the bank.

Her only child, Chukwudi Uche Okocha, explained: “My mother died on August 7, 2004 as a result of breast cancer and my dad died on February 1, 2006. He slept and did not wake up. I am the only child of my parents, I was 17 years old when my mother died. My mum was sick for about eight months, suffering from breast cancer before she gave up. Since my parents died, I’ve been managing, trying to cope through the help of family and friends. There is a particular family that took me under their care and since then I’ve been living with them. And to God be the glory, they have been trying. I got admission into University of Lagos to study Mathematics in 2006. It has not been easy not having one’s parents around.

“My mother spent a lot of money when she was sick due to the nature of the sickness. We all know that it is not easy to manage cancer. But about a month before she died, she told me that she had something in her savings account; that was her salary account. She told me that whatever happened, there was something left in the account. When she died, she was paid her July salary. Before she died, she told me that she had over N200,000 left in her account and when she died her salary was paid into the account. So, there was over N500,000 in the account when she died.”

Chukwudi, who is now 28 added: “But being the only one, I was not able to process the transfer of the money to my account. My dad was unable to process it before he died. Between 2008 and 2009, I tried to process the letter of administration of my mother’s estate through the Lagos probate court and they gave me the certificate to get the money in the account. That was when I applied for the balance and they told me that the balance was about N500. I was shocked because she told me what she had left in the account before she died and I know she did not go to the bank after she told me what she had in the bank. But even if there was no money, the July salary should have been there because it was paid after she had died. And I have a copy of the pay slip for the July salary. When I met Barrister Eluma, I complained to him that there was something wrong with the account.

“When we went to see the then branch manager of the bank, she asked if I was sure that my mother was dead. But she was not ready to disclose anything. So, I felt there was foul play somewhere and I decided to see a lawyer and see what we could do about it. We discovered that two withdrawals were made from my mother’s account in February, 2008; that is four years after she died. Did she come from her grave to withdraw the money from her account? It is a savings account, meaning that she was the only person who could make withdrawals from the account. So, how come withdrawals were made four years after she died? The withdrawals were made by ‘self’ according to the statement of account. It means that somebody, most likely a staff, who knows she was dead or knows something about her withdrew the money.

“What I need now is for them to refund the money and pay some compensation for the inconveniences I have gone through over the years. If I had been able to access the money, it would have been very useful, particularly when I was in school. Again, the value of the money has depreciated in the past 11 years. You can imagine what I could have done if I had gotten the money then. So, they should compensate me.”

Meanwhile, he has written a petition to the Assistant Inspector General of Police in-charge of Zone 2 Command, Nigeria Police, Zone 2 headquarters, Onikan, Lagos. Dated June 17, 2015, it was captioned, RE: *** Account No 2004452106; Account Name: Okocha Cordelia I. Petition On Criminal Breach Of Trust, Fraudulent Misrepresentation, Conspiracy, Forgery, Stealing.

The petition, which was written through his lawyers, J.O, C. Eluma Igwegbe & Co, said: “By this letter we seek to draw your urgent attention to the criminal developments that have taken place in the Awolowo Road Branch of (***) Plc. We do so here because we believe that you will in your usual manner clinically investigate this matter towards bringing Justice to our client and the society at large because of the public concern that may be involved.

“It is part of our client’s instruction that on August 7, 2004, our client lost his mother (herein above outlined as the account name) to breast cancer. It is therefore instructive to say that the said account holder has since 2004 died of breast cancer (see attached death certificate). Our client briefed us that his mother (now the deceased account holder) shortly before her death, informed our client of the existence of over N500,000 in her account as well as the account number, all domiciled in the said *** Bank under its watch. According to our client, his father, Mr. Luke Azubuike Okocha, died on February 1, 2006. Our client is therefore an orphan and the only surviving child of his deceased parents.

“Further to our client’s instruction, sometimes in 2010, our client, (now the lawful heir to the estate of his deceased parents and the Next of Kin to the account of Cordelia I. Okocha (deceased)), sought to obtain Letter of Administration for the purpose of administering his late mother’s estate. The probate Registry then issued him with bank certificate to enable our client to determine the status of the deceased estate including the said account with the Bank. When our client approached the bank for this purpose, he was informed that the closing balance in his late mother’s account was N500 only, instead of over N500,000 the deceased mother told him of. It is the honest belief of our client that some bank officials and other accomplices in the bank frauduour client, (now the lawful heir lently and deliberately misrepresented the true state of the said account to our client during this encounter, with the overall conscious intent to steal the funds of our client’s deceased mother.

“Our client reasonably believe that those bank officials and other accomplices in the bank, conspired to make infractions into the account of Cordelia I. Okocha (deceased) for which our client now has Letter of Administration to administer. This unfortunately amounts to criminal breach of trust.

It added: “In line with our client’s brief we have taken necessary legal steps and made associated expenses to investigate these reckless, wicked, criminal and unlawful acts of the ‘yet to be identified’ bank official and their accomplices.

“Our careful analysis of the deceased’s statement of account now available with us (see attached) revealed that on February 19, 2008, a huge sum of N500, 000 was withdrawn from this account, and Twenty Seven Thousand Five Hundred Naira (N27,500) withdrawn on the 28th February, 2008, four (4) clear years after the death of the said account holder. In your wisdom, is this not fraud by the internal machineries and mercenaries of the bank officials? Our findings reveal that the account in issue here is a savings account. It then presupposes that only the account holder can make any permissible and verified withdrawal, in person. It is a monumental irony and sad financial development in this country to note from the narration on the deceased statement of account on 19/02/2008 and 28/02/2008, that these cash withdrawals were made by ‘SELF’. Was it the deceased that came up from her grave to effect the withdrawal or her spirit? We shall leave this for your investigation.

“Our client being an orphan has suffered untold hardship in the absence of a mother and a father. Our client relied heavily on the money left behind by his deceased mother, kept under the bank’s custody and trust, for his upkeep and care, which unfortunately some of the bank officials and their accomplices have betrayed in the most unprofessional sense as bankers. The criminal acts as outlined above have inflicted grave pains and torture on our client, to a pitiable extent that a good spirited Nigerian family adopted our client and took responsibility of our client’s education and upkeep.

“Our client’s circumstance is put forward here in order to assist you in understanding the depth of criminal infraction into our client’s account and the damages the bank officials and their accomplices have inflicted on the psyche of our client.”

It further said: “It is our client’s full instruction that he has suffered grave damages and injuries by these criminal and unlawful acts, and we reasonably believed to the highest degree that the ‘yet to be identified’ bank officials have breached the trust reposed in them, and have fraudulently and deliberately misrepresented the true state of our client’s deceased mother’s account. The conscious preparation of documents that facilitated the successful withdrawal of funds from the said account amount to forgery and stealing when in fact the account holder has since died.”

In summation, the law firm engaged by Chukwudi expressed the hope that the bank would expeditiously launch an investigation into the matter to uncover the identities of the fraudsters that carried out the brazen forgery and fraudulent withdrawal and bring them to book. Moreover, the law firm demanded that the said first generation bank should refund and re-credit the stolen funds with the accrued interest to the said account. The firm also demanded that the bank should pay the sum of N2 million, representing legal expenses and costs so far incurred by it in pursuing the matter.

No comments:

Post a Comment